With the €24m merger between Baker Tilly South East Europe (BTSEE) and MHA plc completed and announced last Monday, 11 August 2025, the three leading executives from the two companies have revealed more about the significance of the deal.

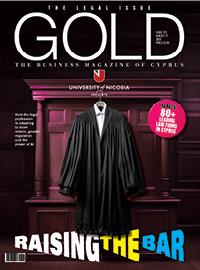

Rakesh Shaunak, the CEO of MHA, as well as Chairman of the firm’s London Head Office and BTSEE’s CEO Marios A. Klitou, and Regional Managing Partner and Head of Tax Services Savvas M. Klitou, recently gave an exclusive interview to CBN and GOLD magazine. Pictured above, from left to right, are Marios A. Klitou, Rakesh Shaunak and Savvas M. Klitou.

BTSEE, a leading professional services firm offering a comprehensive range of services to clients in Cyprus, Greece and South East Europe, earlier this year announced that it had entered into a heads-of-terms agreement to merge with MHA plc, a leading professional services provider of audit and assurance, tax, accountancy and advisory services. MHA is the UK and Ireland's representative of the Baker Tilly International Network.

The proposed deal, first announced at Baker Tilly’s European conference in Athens earlier this year, would see the firm join MHA, supporting the group’s international growth strategy while giving BTSEE access to broader resources and investment to accelerate its own expansion and enhance opportunities for both clients and employees.

Can you tell us more about its aims and main focus of the merger?

Savvas M. Klitou: From our perspective, Cyprus represents a relatively small market compared to larger economies worldwide. However, when considering the other four countries within South East Europe, over the years we have created a significantly stronger and more substantial cluster. The world is evolving rapidly, and remaining static is simply not an option for us.

Over the past few years, our firm has experienced considerable growth, guided by an ambitious yet realistic growth plan. The key questions for us were always: How do we achieve this? and How quickly can we get there? Our relationship with MHA—and with Rakesh personally—spans nearly a decade. What mattered most to us was becoming part of a larger family. We fully recognize the advantages of being part of something bigger, as this is a concept we have already embraced within Southeast Europe.

We share common values, a unified vision, and a very similar strategy for how we each aim to grow our businesses. From a business standpoint, it was evident that by coming together and collaborating, we could accelerate the achievement of our goals significantly.

Rakesh Shaunak: Yes, to echo much of what Savvas has said, working with people, you get to know them, and share aspirations and ambitions. So together, as the MHA group, this will give us a significant European presence, and we intend to use that to go forward and potentially have more mergers of this kind. We see this as a business combination of two equals coming together, both with similar skill sets but a common shared vision, and the sum of the parts will be much greater than the individual bits. So, we are really excited.

How is the move anticipated to impact the Cyprus office? Will there be management changes because of the merger and what economies of scale will be created?

RK: Very positive as far as changes for the Cyprus office is concerned. It is the same team leading the business, building scale with bigger resources and a group structure where Cyprus is at the heart of it. So, a positive impact only. We see growth in the team here and the leadership continuing as it is but playing on a much bigger platform.

Marios A. Klitou: Sharing resources—whether in HR, marketing, or technical training—creates opportunities for greater efficiency and collaboration. This approach benefits everyone: it enhances support for our staff, strengthens our organisation, and ultimately delivers better outcomes for our clients.

RK: So, it is almost the reverse of economies of scale. We see the benefits. We have a central function already in most of the areas and we see Cyprus being able to build on that and therefore grow the team.

Consolidation seems to be a growing trend and was also the subject that was touched upon at a debate at the recent European conference. Can you share your thoughts on why this trend is emerging now and a bit more about how the sector and its clients are benefiting from consolidation?

RK: Fundamentally, consolidation is the only way ahead. Standing still is not an option. Consolidation, building scale is extremely important. Clients benefit from a wider range of services and specialisms, because obviously the larger the resource pool, the more skills you can give them. And there are tremendous opportunities for staff to progress, be part of larger teams, becoming more involved in work they would not ordinarily have been involved in. So, more fulfilment for the staff and, overall, a better service for the clients as well. Also, tech is quite a key element of spending these days. And it gives a much bigger resource pool in terms of financial resources to be able to spend on tech. As a profession, we are not tech-light anymore. Technology is very important. So, all those are benefits that the client sees at the end of the day- the way we deliver our services and the outcomes of the work that we do as well.

MK: We anticipated the market shift and the growing need for consolidation. This trend has been evident globally, and to stay competitive, we had to act. Our listing on the London Stock Exchange and efforts to expand our network across Europe are part of this strategy.

RK: A lot of the firms in the world have decided to go the PE (private equity) route. We made a decision that PE was not for us because ultimately PE requires an exit, and the exit is normally an IPO (Initial Public Offering.) We are ahead of the game, we have done that already and we maintained our independence. We are all going to be shareholders in a listed business but owning the majority of the shares and so we remain in control as a group of partners. And so, we thought the IPO was the obvious option for us, maintaining the culture and maintaining control and trying to move at our pace rather than somebody else outside telling us what to do.

Can you share your view of Cyprus’ role and future prospects as a professional services sector? What is your view of the wider professional services sector in Cyprus at this time?

RK: There is great opportunity here. Geographically, Cyprus sits in a key location. Historically, there have been investors and people from different jurisdictions, but that balance is changing. I was interested to hear recently that the tech industry in Cyprus, for example, is now the largest industry. So, there are lots and lots of opportunities. We see Cyprus being at the heart of our drive into Europe, really. We are the fifth largest firm in Cyprus already so we’re in a really powerful position.

SK: The professional services industry in Cyprus is highly mature and aligns closely with the standards in the UK. We share the same commitment to quality, ethics, and client service, ensuring consistency whether clients engage with us in Cyprus, the UK, or elsewhere in Europe. Cyprus has reached an advanced stage in terms of service quality, which continues to impress clients. Over the past 30 years, we’ve consistently seen clients recognise the exceptional standards we deliver—often exceeding those in other European jurisdictions.

RK: Yes, that is a really good point Savvas. I would maybe add to that, being part of a UK-regulated business is actually going to be quite a powerful message to the market. And that produces quite a unique factor into the market as well.

MK: Given the size of the local market, Cyprus has always looked outward, focusing on attracting international investment. Over the years, it has established itself as a hub for global businesses entering Europe and the EU. This success is driven by Cyprus’s business-friendly environment and the profession’s deep expertise in international matters. Joining a larger group that includes the UK strengthens this position, enabling us to attract even more business through shared knowledge and a collaborative approach.

Can you tell us a bit more about how things are changing, including in terms of tech, and how they are anticipated to evolve even further?

RK: Yes, tech is going to play a key role in professional services business of the future. We see tech as essential, almost existential. Unless you move with the times, you lose your relevance in what you provide for clients.

And also, it gives the opportunity for people to really do the work they enjoy, letting tech do the heavy lifting, and all the ‘boring’ work while people do the value-added work, which is what they like to do which keeps their interest, and gives them a path forward as well.

SK: Our people expect us to invest in technology that makes their work easier and more efficient. Younger professionals want to focus on the value-added aspects of engagements rather than routine data analysis. They want to be at the forefront—participating in client meetings and seeing how we deliver real value to our clients. Investing in technology and AI allows us to meet these expectations, demonstrate our commitment to the future, and enhance the value we provide to clients.

RK: Client service and that people element is a differentiator. It is the difference between the machine producing the analytics and somebody sitting in front of them and saying, ‘This is actually what it means, and this is how it could improve your business.’

Finally, how are the professional services being impacted by geopolitical events, whether this be around Cyprus or on a global level? Have you seen any impact in your day-to-day business and experiences from the US tariffs, from Ukraine, from Israel and Gaza etc.?

MK: The uncertainty around U.S. tariffs has not impacted Cyprus so far—it’s essentially business as usual. Our direct trade with the U.S. is limited, so the immediate effect is minimal. However, any impact on our main trading partners will eventually influence us.

SK: To add to that, we live in an incredibly fast-moving world where geopolitical and economic events occur with unprecedented frequency. One certainty, however, is that Cyprus has consistently demonstrated reliability and stability in recent years. This stability gives clients confidence that, despite global volatility, Cyprus remains a secure and dependable base for their business.

RK: Just following on with what Marios and Savvas have said, this world is looking for stability and some of the decision making has been very erratic and caused a huge amount of uncertainty. We’ve spoke about Cyprus , but looking at it from a UK perspective, we have a very stable government, we have a good infrastructure, and it creates a really good opportunity for people to be looking at the UK and Europe as a very stable environment. So, the axis has shifted from perhaps being more US centric to people looking for alternative safe havens. Stability is the keyword.

MK: What the markets do not want is uncertainty.

Is there any other message you would like to give or something you would like to emphasise?

RK: The key message is opportunity. What our merger demonstrates is the opportunity and the fact that there are ways one can expand, go beyond one's borders and horizons. And that is that is the key message in all this, that we are doing something quite unique and ahead of the game. So that is the key message from me.

MK: One of the key slogans of Baker Tilly is ‘Now, for tomorrow.’ Mr. Shaunak could change it to ‘Together, for tomorrow’ and this is a very catchy and interesting point, ‘Together, for tomorrow.’

SK: As we enter this new chapter—part of a much bigger story—we take great pride in our 30-year history and what we’ve built in Southeast Europe. The momentum we’ve gained in recent years has been a key driver of our success and maintaining that momentum is essential. It inspires our people, fuels growth, and helps us meet the rising expectations of both our team and our clients. This next phase will allow us to accelerate that progress, continue developing our firm, and deliver even greater value.

(Photo by TADOBI)