BridgerPay introduces first agnostic omnichannel payment operations platform (video)

08:51 - 08 December 2023

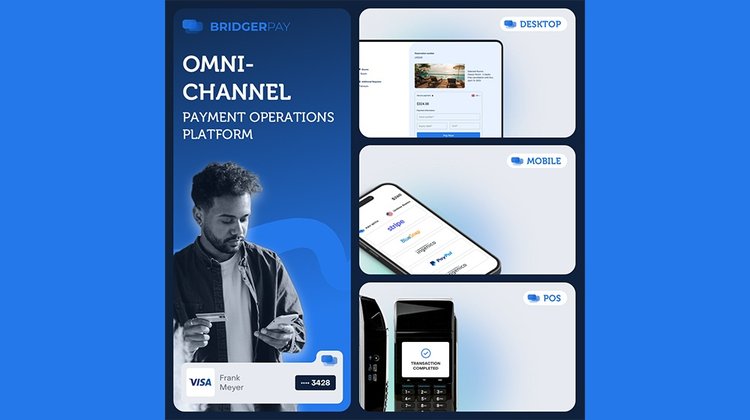

Payments industry payment technology pioneer BridgerPay has announced its transformation into a powerful omnichannel payment operations platform.

An announcement from the company notes that the move brings about unparalleled control and flexibility to businesses seeking to streamline their payment processes across all payment channels - ecommerce shops, physical stores and mobile applications.

"The transition to an omnichannel payment operations platform represents a significant positioning as a technology leader for BridgerPay, filling the untapped gap of omnichannel orchestration and payment operations that exists in the world, a pain shared by many enterprise merchants that run a multi-channel business," the statement continues.

According to the company's announcement, the concept of "omnichannel" used to revolve around a business's capacity to process transactions across all channels using a single payment provider.

"Now, envision a world where you have the power to choose your preferred payment service provider for each channel. This is precisely what BridgerPay has crafted – an agnostic omnichannel solution that empowers merchants to optimise processing in any channel, from anywhere," the announcement notes.

It continues, "Imagine that there are no boundaries restricting your business payments. Both your online and offline operations seamlessly process payments using the most suitable solution for each channel and geographic region. Picture a scenario where all your payments flow through your central management system, ensuring complete automation across all channels. This means you can initiate and process a transaction in a point of sale directly from your management system. Furthermore, you have the flexibility to obtain credit card tokens directly from the point of sale and use them later in your PMS or CRM, with the option to add fallback payment providers to optimise the approval ratio."

Ran Cohen, CEO of BridgerPay, emphasises the transformative impact of BridgerPay’s platform, "We're on an exciting journey that's set to reshape the payment landscape for businesses. In today's dynamic business environment, it's essential to provide companies with the tools they need to simplify and improve their payment processes. This milestone development, the first of its kind, was born from a genuine need. Our enterprise clients, who already trust BridgerPay, approached us with a request to expand its functionality offline, for example, in physical stores or hotel front desks. Transforming these client requests into reality is at the core of our mission. As a result, we've created a revolutionary omnichannel payment operations platform that promises to fundamentally redefine how businesses navigate and manage their payments."

According to the company, the move's impact on business includes:

Unparalleled Control: Automation across all channels, with your payments flowing through a central management system streamlines your payment processing and enhances operational efficiency.

Connectivity: Experience the effortless flow of transactions between any payment channel and your systems, ensuring error-free operations. This provides you with precise control to initiate point-of-sale transactions and retrieve tokens from credit cards, guaranteeing accuracy and efficiency in your processes.

Payment Optimisation: Each channel your business operates in will be optimised, tailored specifically to its geographical location. This approach enables you to achieve the highest approval ratios across all your channels, both in physical point of sale and ecommerce.

Risk Mitigation: The freedom to choose the most suitable payment provider for each channel allows you to diversify and spread the risk across various payment providers. This flexibility is crucial for risk management, as not every payment provider for point-of-sale (POS) transactions is ideal for e-commerce.

Boosted Revenue: Along with the tools the BridgerPay platform offers, the freedom to choose the most suitable payment service provider for each channel, whether it's web, mobile, or point of sale, significantly boosts your revenue.

PCI & Security: By using BridgerPay as your omnichannel payment operations platform, you automatically eliminate your PCI scope. This not only enables the secure transmission of credit card information but also upholds a safe and reliable environment, further enhancing the security of your payment processes.

The shift to an omnichannel payment operations platform positions BridgerPay as a forward-thinking industry leader dedicated to delivering innovative payment solutions to meet the diverse needs of businesses across all sectors, especially those that handle payments through multiple channels.

To learn more about BridgerPay and its omnichannel payment operations platform, please visit https://bridgerpay.com/omnichannel.