Nicos Rotos, CEO of Rotos Group, expresses optimism about the future of the real estate sector in Cyprus, while noting the numerous challenges it faces, including a lack of human resources, high inflation, geopolitical tensions and the ever-present problem of bureaucracy.

In a recent interview with GOLD magazine, Rotos also talks about how the market has been impacted by the entry of foreign capital as well as by local government reforms. In addition, he discusses to what extent government policies are shaping development trends in the real estate sector.

What is your outlook for the real estate market over the next 12-18 months? Which segments do you expect to experience significant growth?

I expect 2025 and 2026 to be very good years in the construction sector, due to low deposit interest rates and relatively high inflation, which favour real estate investment. The high demand for rentals also makes real estate investment a safe and profitable option. In the residential segment, demand is expected to remain high. The change in working patterns (such as working from home) reinforces the preference for larger and more spacious living areas, as well as more service-rich residential complexes. There is also considerable demand for commercial buildings, from Cypriot companies as well as companies and professionals from abroad. The industrial real estate sector, especially as regards warehouses and distribution centres, is expected to benefit from the increase in online sales, while developments that combine residential, commercial and office space are expected to become more popular, meeting the needs of different users. Finally, sustainable and green developments that meet environmental standards and focus on sustainability will likely be more in demand as consumers become more aware of environmental issues.

The local real estate market has demonstrated considerable resilience but it is not without its problems. What are the biggest challenges the industry will face this year and beyond?

The lack of human resources is the biggest challenge facing our industry. Digital transformation and technologies such as AI & VR will affect some processes but will never replace human labour, on which the construction industry has always relied almost exclusively. Bureaucracy continues to be a big problem and the Government must respond and support our industry directly. It needs to become more aware, acknowledge the issues at hand and assist accordingly. The licensing process for large-scale developments is another challenge. Inflation, interest rates, geopolitical tensions and the related prolonged uncertainty, the high cost of energy and construction materials are all factors that will continue to concern not only our industry but all sectors of the economy. These challenges require strategic planning by both real estate professionals and the Government, to ensure continued growth and stability in the sector.

Compared to other Mediterranean destinations, how competitive is Cyprus in attracting international clients and institutional investors? What are the country’s key advantages and where do you see vulnerabilities?

Cyprus has several advantages that make it attractive to international clients and investors but it is important to also recognise the challenges that need to be addressed to maintain its competitiveness in the region. On the plus side, it offers a favourable tax regime with relatively low corporate rates and incentives that attract investors. As a bridge between Europe, Asia and Africa, Cyprus offers access to foreign markets, making it attractive for businesses wishing to invest in these regions. The country has a well-educated workforce with a knowledge of international markets, which facilitates business activities and foreign investment. The pleasant climate, beautiful beaches and authentic culture attract not only investors but also international buyers who wish to settle in Cyprus. However, there are also some vulnerabilities that require attention such as political tensions in the Mediterranean region and relations with neighbouring countries that may cause concerns for investors. Intense competition from other Mediterranean countries – Greece, Malta, Italy and Spain – which offer similar advantages and attractive investment programmes is also a challenge.

The island’s high-end property market is drawing increased attention from institutional investors, private equity funds and family offices. In your experience, how is the influx of institutional capital reshaping the real estate landscape?

The entry of foreign capital into Cyprus’ high-quality real estate market has brought about significant changes. Funds typically seek to invest in projects that meet high quality and design criteria. This has led property developers to invest in more innovative and sustainable approaches to their projects. High-end projects reinforce the image of Cyprus as a worthwhile property investment opportunity. Foreign investors are paving the way for new opportunities in the real estate sector, such as mixed-use developments and the renovation of old properties. With their support, projects that were previously considered unviable or prohibitive can now be successfully undertaken. The inflow of foreign capital can accelerate the development of new projects in Cyprus, as investors often have the ability to finance large-scale projects more quickly and efficiently. This can lead to faster economic growth and an increase in the supply of residential and commercial real estate. Demand from foreign investors has, of course, affected property prices, usually leading to price increases in specific areas. This requires prospective buyers and investors to reevaluate their strategies.

It’s now more a year since local government reforms were implemented. What has their impact been on the real estate industry and is there room for further improvement?

I believe that they have generally brought some advantages but continuous improvement and adaptation are needed to ensure that local authorities respond to citizens’ needs effectively and transparently. It is important to strengthen direct communication between local authorities and citizens. Proper education and training of local government employees are necessary for them to improve their skills and ensure the implementation of best practices in management and service provision. It is essential that policies and programmes are systematically evaluated to identify any weaknesses and that strategies are adjusted in accordance with actual or expected performance. We expect to see much more from local government reforms.

To what extent are government policies shaping development trends in the real estate sector?

Government policies have a significant influence on current trends in the real estate sector. Tax breaks and other incentives for foreign investors have encouraged a massive inflow of foreign capital. This has led to an increase in demand for residential and commercial projects, creating opportunities for property developments and investments. Fast-track procedures for building permits have significantly reduced the time required to approve new small-scale projects but, unfortunately, large-scale developments continue to experience significant delays which, in turn, increase costs. Subsidies for sustainable and environmentally friendly projects have promoted the creation of properties that meet new environmental standards. These policies not only enhance ecological awareness among investors but also provide strong incentives for developers to opt in for more sustainable projects. Lastly, the implementation of programmes such as build-to-rent has provided new opportunities for investing in properties specifically intended for long-term rental. Overall, the Government’s policies support and guide growth in the local real estate industry, creating beneficial outcomes for the economy and housing supply. The continuous evaluation and adaptation of these policies to market needs will be crucial to ensure the sustainable development of the sector.

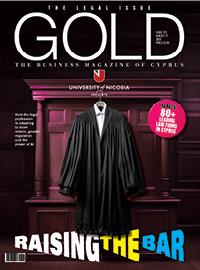

This interview first appeared in the May edition of GOLD magazine. Click here to view it.