Yaron Hershcovich, Chief Technology Officer at BridgerPay, discusses algorithms, artificial intelligence (AI) trends and bottlenecks in integrating AI solutions – among other things.

As he says, crucial work needs to be done in order to separate true AI from marketing buzzwords.

What are the specific AI tools that you have adopted? How well did they integrate with your existing infrastructure? Did they require specific customisation to work effectively?

At BridgerPay, we view AI not as a single tool but as a core capability woven into our platform. Our AI implementations primarily focus on enhancing our core mission: optimising payment processing and ensuring security for our merchants. Key areas include AI-powered Transaction Routing (Bridger Retry™ & Router), which uses machine learning to pick the best payment service providers for each transaction, boosting approval rates. Customisation was key to training the models on our diverse transaction data. We’re exploring AI-powered developer tools to boost productivity. These tools, which include AI-assisted code writing, automated code review and intelligent PR analysis, can speed up development, reduce errors and improve code quality, allowing developers to focus on more complex tasks. We’ve implemented AI-powered chatbots for first-line support queries, handling common questions about integration, transaction behaviours, etc. This is integrated with our existing dashboard and support ticketing systems. While the initial setup used standard NLP models, customisation was needed to build RAG (Retrieval-Augmented Generation) and some proprietary techniques so that our bot agents could understand BridgerPay-specific terminology, processes and knowledge base articles.

Have these AI deployments led to revenue growth, cost savings, or improved customer retention? Can you quantify these improvements? And how long will it take before you see a measurable return on your investment?

The impact has been significant across the board. Our AI-driven routing directly increases merchant revenue by boosting payment approval rates. We’ve seen merchants achieve uplifts of 5-15% in approval rates, depending on their traffic profile. This translates directly into recovered revenue for them and increased processing volume for us. AI-powered developer tools, including AI-assisted code writing, automated code review and intelligent PR analysis, boost developer productivity and code quality. This enables faster development and more frequent release cycles, allowing us to onboard new clients and payment service providers quickly and efficiently. There has also been improved customer retention, as higher approval rates and lower fraud directly lead to happier merchants. Additionally, a faster understanding of merchant performance allows us to understand payments bottlenecks and performance in near real time.

What have been the biggest bottlenecks in integrating AI solutions? How did you overcome these challenges?

The challenges have been multifaceted. Data quality and availability are paramount, as AI models are only as good as the data they’re trained on. Ensuring clean, comprehensive and properly labelled data from diverse global sources was an initial hurdle. So we invested heavily in data engineering, implementing robust data validation, cleansing pipelines and establishing clear data governance policies. While BridgerPay prides itself on modern architecture, integrating cutting-edge AI sometimes requires interfacing with older protocols or systems within the broader payments ecosystem (e.g. certain acquirers). To solve this, we built flexible APIs, middleware adapters and employed a strategy of gradual, modular integration rather than a “big bang” approach. Introducing AI changes workflows, so initial scepticism or resistance from teams accustomed to traditional methods can occur. The solution is clear communication about the benefits (reducing tedious tasks, enhancing capabilities), involving teams early in the design and testing process, providing thorough training and celebrating early wins.

As AI continues to transform the workplace, how has BridgerPay adapted? How have employees responded and what steps have you taken to support this transition?

AI is definitely reshaping roles but largely through augmentation and evolution rather than direct replacement. At BridgerPay, AI’s role is primarily to enhance productivity and empower our team to overperform, rather than replace existing roles. As a small-to-mid-sized company, running lean and effective is core to our nature. We’ve seen the emergence of new roles like AI/ML Engineer (Payments Focus), Data Scientist (Risk Optimisation) and AI Marketing Specialist. These roles focus specifically on developing, managing and refining our AI capabilities. Naturally, there was some initial apprehension from employees, often stemming from uncertainty. However, the response has become increasingly positive as they see how AI tools can remove repetitive tasks, enhance their own effectiveness and allow them to focus on more strategic or engaging work. Seeing tangible results like reduced fraud or higher approval rates also builds buy-in. We communicate openly about our AI strategy, the specific tools being implemented and why. For training and reskilling, we offer workshops, online courses and on-the-job training to help employees understand and utilise new AI tools effectively. This includes basic AI literacy for broader teams and specialised training for those working directly with AI systems. We emphasise that AI is a tool to assist humans, not replace them. We design workflows where human expertise and AI capabilities complement each other. And we actively solicit feedback from employees using AI tools to identify pain points and areas for improvement.

In your industry, what types of decisions can realistically be entrusted to an algorithm? And do you think that AI will ever be capable of handling the novelty and ambiguity of executive-level decision-making?

In payments, AI is already adept at handling decisions that are data-intensive, pattern-based and require speed and scale. Such decisions include assigning risk scores to transactions based on thousands of data points instantaneously, selecting the best acquirer path based on maximising the likelihood of success and minimising cost/latency, forecasting transaction volumes, identifying emerging potential trends from aggregated data and matching transactions across different ledgers. However, decisions involving significant ambiguity, ethical considerations, long-term strategic planning, complex stakeholder management or fundamental shifts in business direction remain firmly in the human domain.

Which AI trend or technology are you watching closely and which do you think are more marketing fluff than substance?

AI agents – autonomous systems capable of performing complex, multi-step tasks – are gaining traction. These agents are evolving from standalone tools to collaborative networks where multiple AIs work together as a team. As AI models grow in power and complexity, there’s a push toward sustainability. Innovations in energy-saving hardware (like specialised chips) and software optimisations are reducing electricity consumption without sacrificing performance. Trends that are more marketing fluff (or currently overhyped) include vendors simply rebranding existing analytics or automation tools as “AI” without incorporating genuine machine learning or deep learning capabilities. Critical evaluation is necessary to separate true AI from marketing buzzwords. Also, the idea that you can just plug in a generic AI model and have it magically solve complex payment optimisation or fraud problems without deep customisation and domain expertise is often misleading.

What is the one AI breakthrough that you believe will be a game-changer for your industry?

A critical AI breakthrough would be the ability to detect when AI is being used in fraudulent or deceptive scenarios, particularly for vulnerable individuals who are most likely to be targeted. As Generative AI becomes more sophisticated, the risk of abuse in areas like phishing, social engineering and impersonation grows significantly. Developing robust AI-driven detection mechanisms that can differentiate between human and AI-generated interactions in real time would be a game-changer. This capability could act as a digital safeguard, alerting both users and service providers when an interaction is potentially malicious or artificially generated, helping to protect trust, reduce fraud and uphold ethical standards in increasingly automated environments.

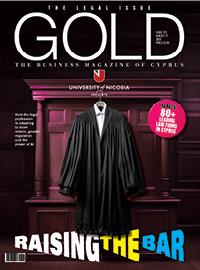

- This article was part of GOLD magazine’s Cover Story in April. To view it click here