Cyprus firms devote highest percentage of their investments to developing new products and services, EIB Survey finds

07:25 - 25 October 2024

The European Investment Bank’s Investment Survey 2024 included some interesting revelations about business in Cyprus, including that firms on the island devoted the highest percentage of their investments, in Europe, to developing new products and services.

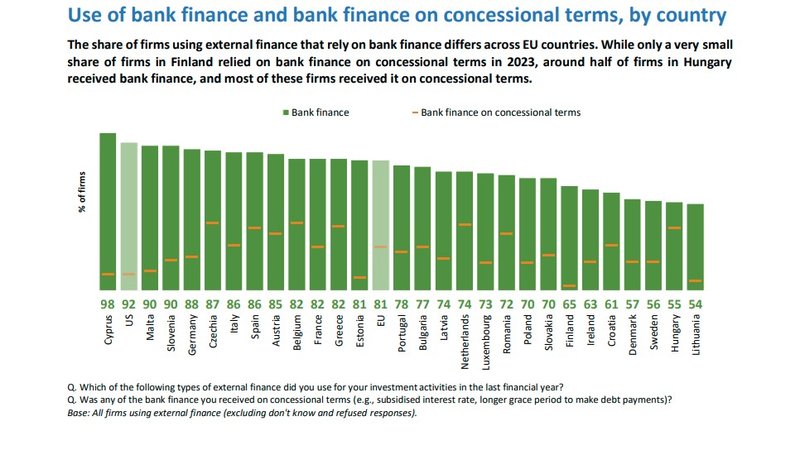

Cyprus also stood out when it comes to the share of firms using external finance that rely on bank finance differs across EU countries, topping the Survey’s list.

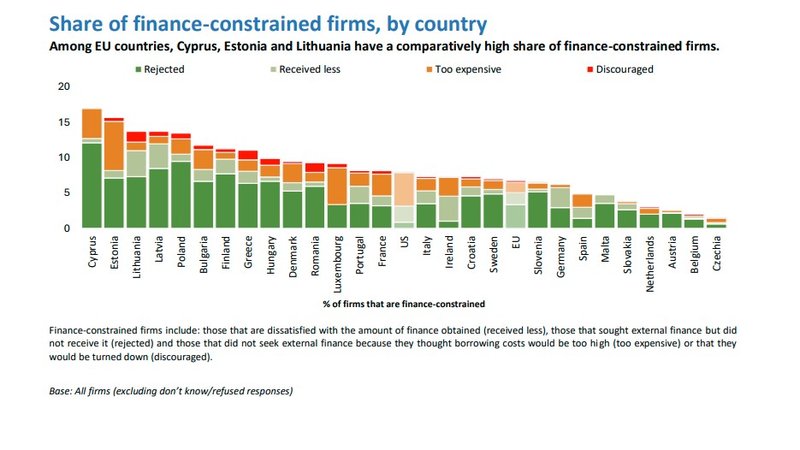

The country was also at the top of the list in the category of ‘Share of finance-constrained firms.’

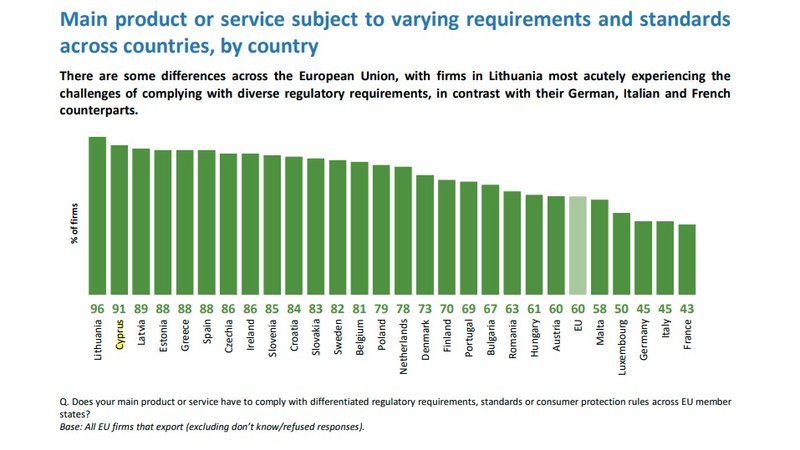

According to the Survey, Cyprus was in second place on the list in terms of the percentage of firms with a ‘Main product or service subject to varying requirements and standards across countries.’

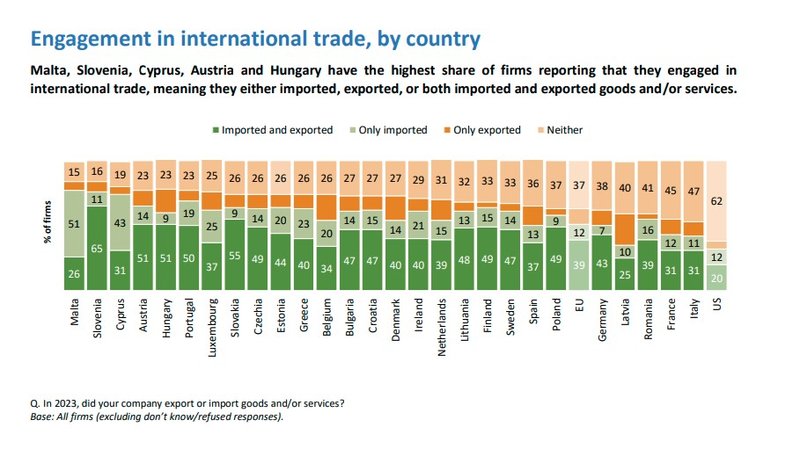

This fits in with the country also being among those with the most ‘Engagement in international trade.'

The Survey also found that Cyprus has a way to go in several categories, for example, the island was at the lower end of the spectrum when it comes to ‘Future investment priorities,’ and 'Building resilience to physical risk.’

The EIB’s Investment Survey 2024 was released on 23 October at the World Bank-IMF Annual Meetings in Washington, and paints a picture of leadership of EU businesses, among other things, in the green transition and the reinforcement of their supply chains in the face of heightened geopolitical risks and supply-chain disruptions.

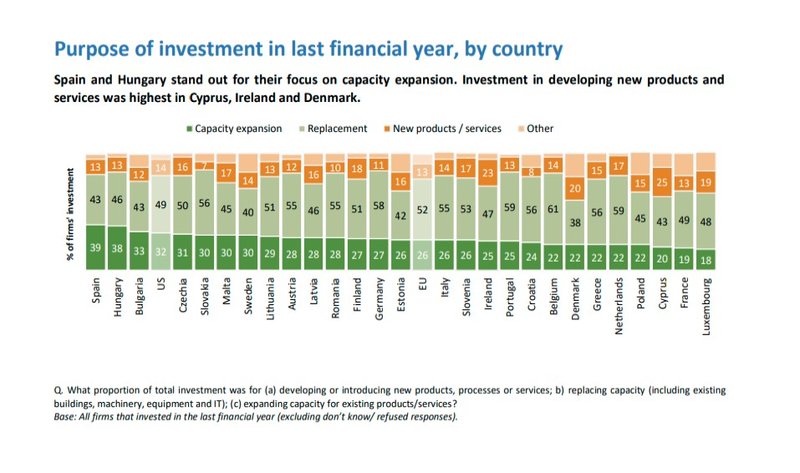

Taking a look at the Survey's findings on Cyprus in more detail, when it comes to ‘Purpose of investment in last financial year,’ investment in developing new products and services was highest in Cyprus, Ireland and Denmark while Spain and Hungary stand out for their focus on capacity expansion.

As mentioned earlier, Cyprus, once again, topped the list when it came to the share of firms using external finance that rely on bank finance differs across EU countries, with 98%.

Cyprus was also at the top of the list in the category of ‘Share of finance-constrained firms,’ with the Survey noting, “Among EU countries, Cyprus, Estonia and Lithuania have a comparatively high share of finance-constrained firms.”

Finance-constrained firms include: those that are dissatisfied with the amount of finance obtained (received less), those that sought external finance but did not receive it (rejected) and those that did not seek external finance because they thought borrowing costs would be too high (too expensive) or that they would be turned down (discouraged).

In ‘Main product or service subject to varying requirements and standards across countries,’ Cyprus was in second place with 91% of firms reporting this, behind only Lithuania with 96%. There are some differences across the European Union, with firms in Lithuania most acutely experiencing the challenges of complying with diverse regulatory requirements, in contrast with their German, Italian and French counterparts.

Cyprus was also among the countries with the most ‘Engagement in international trade.’

According to the Survey, “Malta, Slovenia, Cyprus, Austria and Hungary have the highest share of firms reporting that they engaged in international trade, meaning they either imported, exported, or both imported and exported goods and/or services.”

More specifically, it was listed in third place with 31% of firms saying they had exported or imported goods and/or services in 2023, 43% saying they had only imported and 19% saying they had done neither.

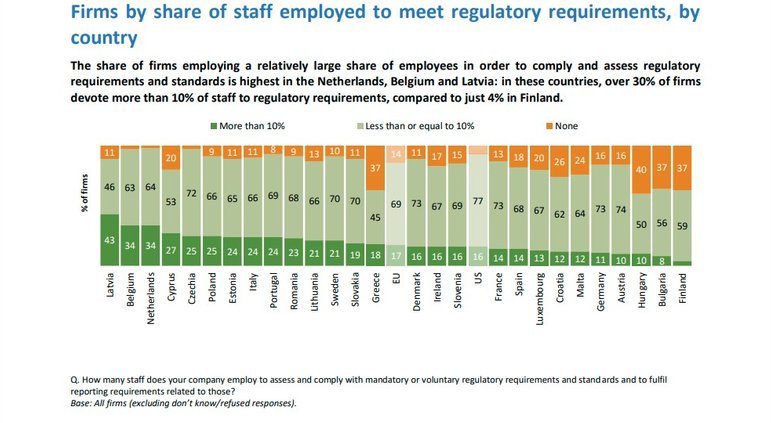

Cyprus was fourth from the top in ‘Firms by share of staff employed to meet regulatory requirements.’

The share of firms employing a relatively large share of employees in order to comply and assess regulatory requirements and standards is highest in the Netherlands, Belgium and Latvia: in these countries, over 30% of firms devote more than 10% of staff to regulatory requirements, compared to just 4% in Finland. In Cyprus, the percentage of firms with more than 10% was 27%.

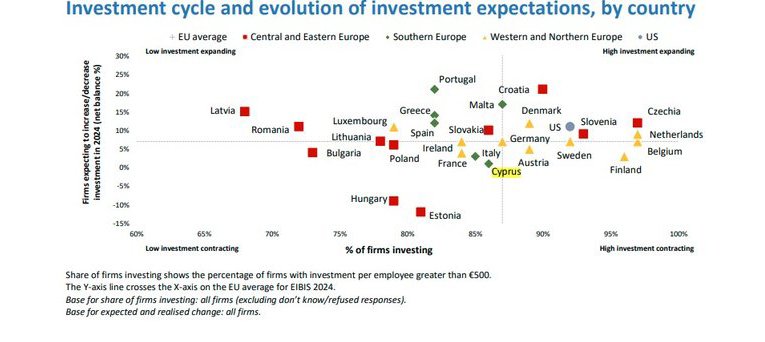

Within the section on ‘Investment cycle and evolution of investment expectations’ and more particularly when it comes to ‘Firms expecting to increase/decrease investment in 2024 (net balance %)’ Cyprus featured in the category of ‘Low investment contracting’ but was among the countries closest to entering the ‘High investment contracting’ section.

In the category of ‘Investment areas,’ Cyprus was found to dedicate 18% of its average investment share to ‘Land, business buildings and infrastructure,’ 50% to ‘Machinery and equipment,’ and smaller percentages to ‘Research and development, Software, data, IT and website activities,’ ‘Training employees’ and ‘Organisation/business processes.’

When it comes to the ‘Perceived investment gap,’ Cyprus was among the countries where it was considered that the right amount had been invested, with this answer taking 87% of the total. Only 6% of the respondents in Cyprus said they had invested too little, among the three lowest percentages.

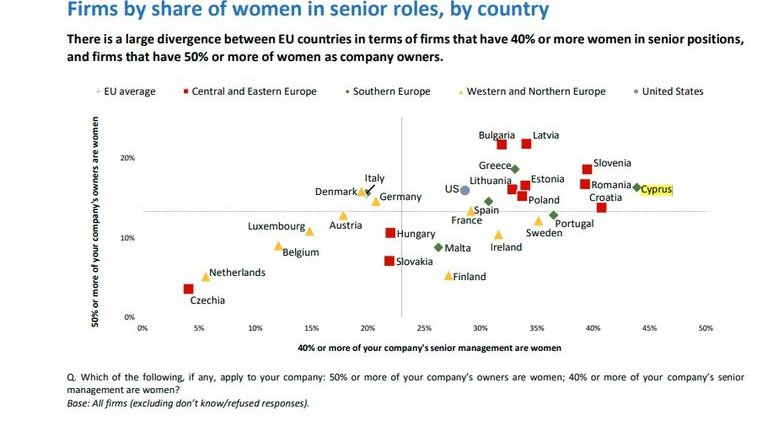

In ‘Firms by share of women in senior roles,’ meanwhile, Cyprus featured above the EU average.

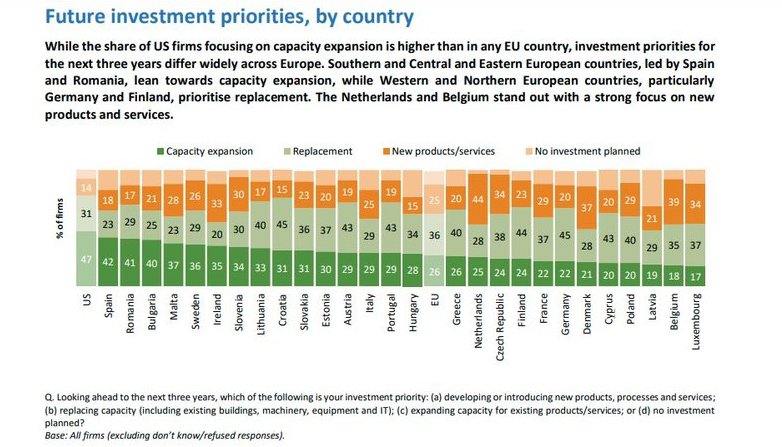

Cyprus was at the lower end of the spectrum when it comes to ‘Future investment priorities,’ where the report said, “While the share of US firms focusing on capacity expansion is higher than in any EU country, investment priorities for the next three years differ widely across Europe. Southern and Central and Eastern European countries, led by Spain and Romania, lean towards capacity expansion, while Western and Northern European countries, particularly Germany and Finland, prioritise replacement. The Netherlands and Belgium stand out with a strong focus on new products and services.”

For Cyprus specifically, the percentage of firms saying they had reached ‘Capacity expansion’ stood at 20%, the percentage putting themselves in the ‘Replacement’ category stood at 43% and those who put themselves in the ‘New products/services’ category amounted to 20%.

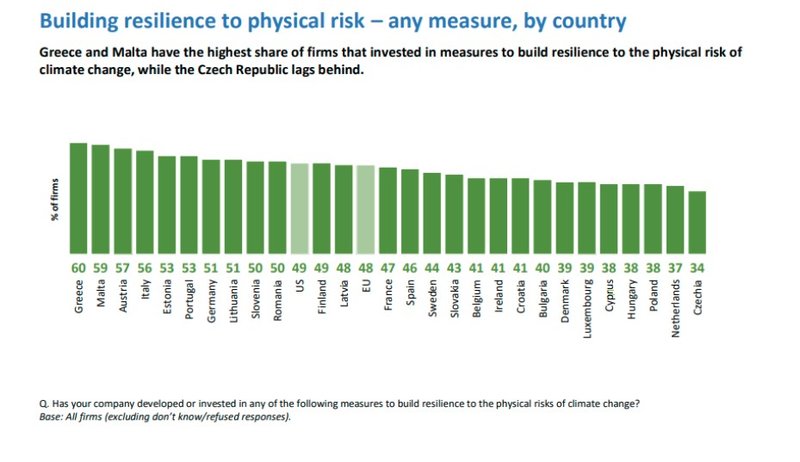

In the section on ‘Building resilience to physical risk – any measure,’ Cyprus was, again, at the tail-end of countries that had invested in measures to building resilience. Greece and Malta had the highest share and Czechia the lowest with 34% of firms saying they had invested in measures to build resistance to the physical risk of climate change. In Cyprus, the figure stood at just 38%.

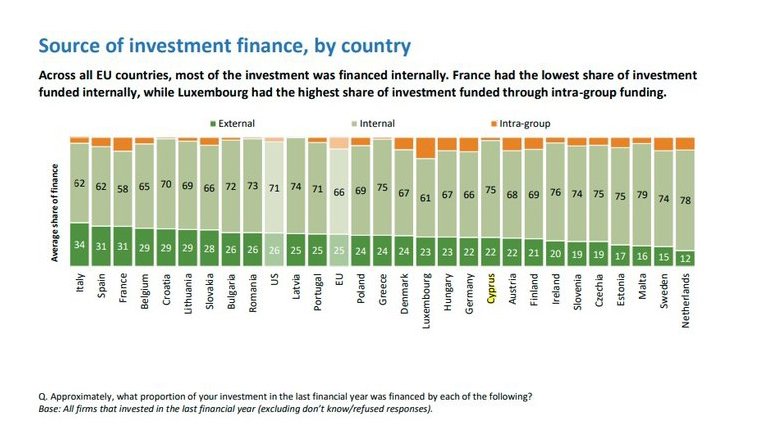

Cyprus was also in the lower half when it came to ‘Source of investment finance,’ with 22% coming from ‘External’ funding, 66% from ‘Internal’ funding and the remainder from ‘Intra-group.’ France had the lowest share of investment funded internally (58%), while Luxembourg had the highest share of investment funded through intra-group funding.

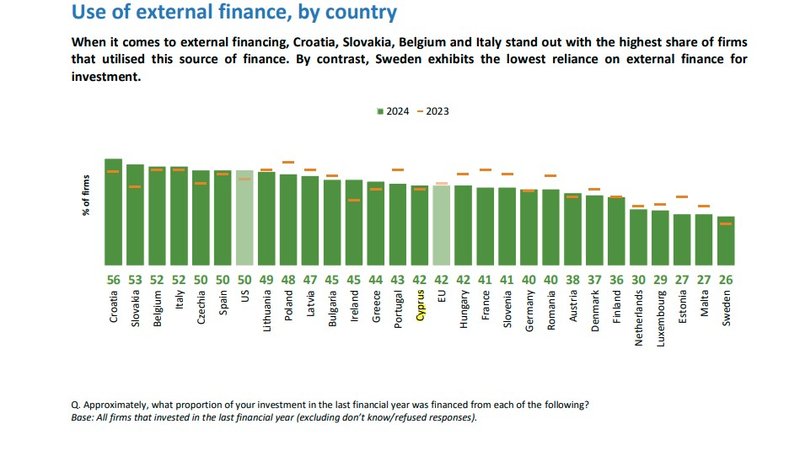

When it comes to ‘Use of external finance,’ Croatia, Slovakia, Belgium and Italy stand out with the highest share of firms that utilised this source of finance. By contrast, Sweden exhibits the lowest reliance on external finance for investment. Cyprus was, again somewhere in the middle.

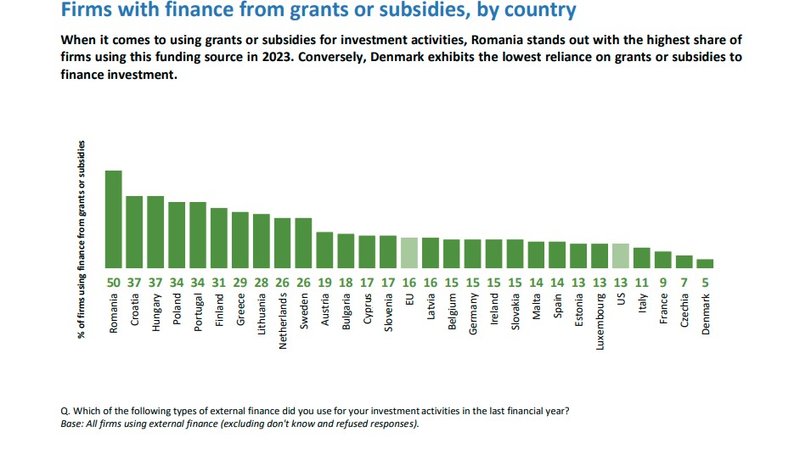

Cyprus was also in the middle of the graph in the category of ‘Firms with finance from grants or subsidies,’ with 17% of firms using finance from grants or subsidies, compared to 50% in Romania and 5% in Denmark.

In the ‘Financing cross,’ category, the Survey found that overall, across the EU, countries with a lower share of firms that are happy to rely on internal finance seem more likely to be financially constrained. In Cyprus, the percentage of firms that were happy to rely on international funds or did not need the finance stood at close to 30%, the Survery found.