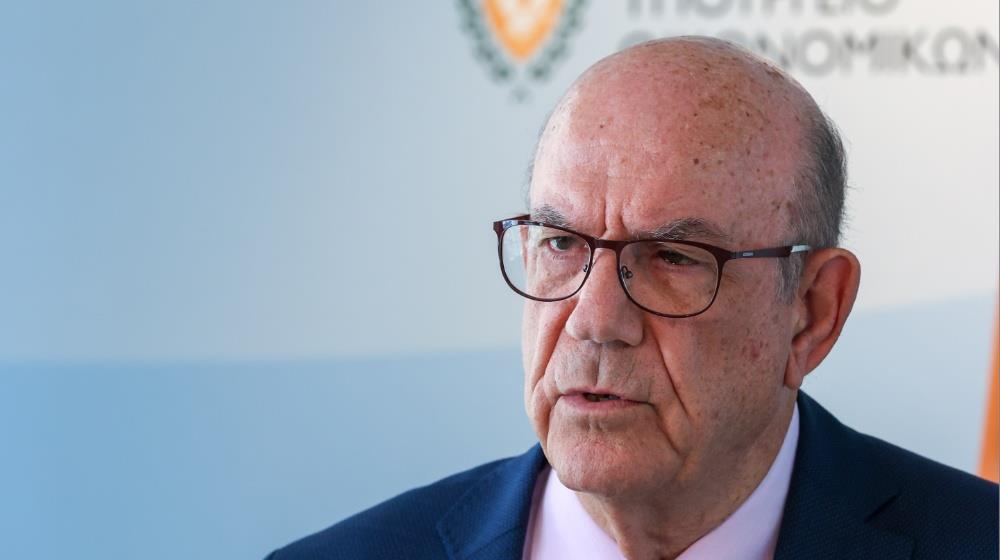

Finance Minister Makis Keravnos has said that the issue of interest and compound interest on loans handled by credit acquisition companies is of concern.

Replying to journalists' questions on 13 February, Keravnos said that the Ministry is concerned about the issue and that it is in the process of examining the data available to the Central Bank and that consultations are underway.

Asked whether the Ministry is concerned about the loans handled by credit acquisition companies and the debt that is accumulating, Keravnos said that indeed the issue of interest and compound interest creates this situation, adding that “it is something that concerns us, it concerns the Ministry of Finance and we are studying the data, which is mainly in the possession of the Central Bank at this time”.

The Minister of Finance also referred to various consultations that are taking place, such as his recent meeting with the Financial Commissioner, with whom they exchanged views on various topics, including on the particular issue.

Asked if there will be any actions, such as legislative regulation or an action plan like the "Rent vs Installment” scheme, he said that there is still nothing specific, adding that our actions in this area must be cautious as 'many are watching and evaluating us'. We are concerned and are studying the issue, he went on to say.

The Minister was also invited to comment on statements made by the Minister of Justice that crime starts within businesses, and whether there are weaknesses regarding the monitoring of those businesses. “There are no weaknesses, these businesses are audited and there is close cooperation with the police”, he stressed, noting that he knows the issue very well, as he is the one who signs for various financial data and accounts to be examined.

(Source: CNA)