Too few people participate in Europe’s capital markets relative to other developed countries, and too many do so without understanding the risks. The EU is expanding access through reform, but without a parallel push on financial education, vulnerable consumers risk being overexposed or excluded. To bridge this gap, regulators must both educate and enforce.

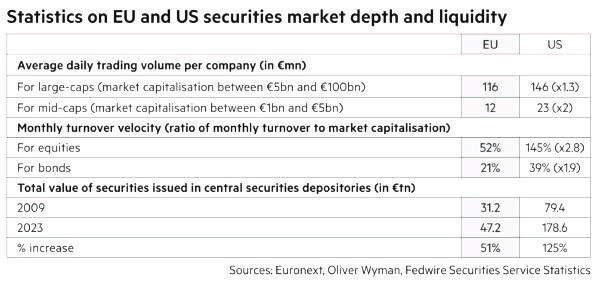

EU consumers — and those in the UK — hold a significantly smaller percentage of their wealth in equities and mutual funds than their counterparts in other G7 nations, particularly the US. This undermines their long-term financial interests and does little to foster strong economic growth.

To address this, the EU’s retail investment strategy aims to adapt disclosure rules, enhance transparency and comparability of costs, and tackle misleading marketing. While these measures are welcome, they come with significant risks.

Policymakers must give meticulous consideration to the impact of proposed reforms. After July, we will have more information about why savers feel deterred from engaging, as the European Securities and Markets Authority concludes its call for evidence on the retail investor journey.

This will examine the appeal of speculative products to young investors, the influence of social media on decisions, and whether current rules support or hinder participation.

We all know that making investments more accessible does not automatically mean everyone should invest.

The recent surge in retail participation in the stock market has presented new challenges and expectations for supervisory authorities, as more vulnerable consumers put their money into high-risk products. It is here that regulators can perform a critical, societal role.

Young bulls, old tricks

We have been particularly concerned by the growing participation of inexperienced investors, who can be heavily influenced by social media hype and emotionally charged advertisements.

Some of these products exhibit diverse risk profiles and retail shareholders might not fully understand their implications. This is where the importance of financial education and inclusion come into play.

The Cyprus Securities and Exchange Commission has a strong track record in promoting investor education spanning more than a decade.

We believe it is our responsibility to provide an educational role model for young Cypriots.

As part of my country’s national strategy, financial education is being incorporated into the curricula of secondary and primary schools. CySEC recently completed its third round of lectures at schools. So far, this programme has been attended by more than 1,700 students.

- At the primary school level, we focus on budgeting, saving, building an emergency fund, understanding how debit cards and bank accounts work, avoiding scams and recognising risk.

- In high schools, there is a strong emphasis on digital finance and cybersecurity, reflecting the fact that many students are already exposed to online platforms, cryptocurrency ads on social media and to finfluencers.

- At university level, CySEC delivers lectures that dig deeper into investment risk, capital markets, the role of financial supervision and ethical finance. The recurring theme is how regulation protects investors and ensures the healthy function of markets.

Jeopardy rising

What we’ve learned is that financial confidence among young people is low. Students often overestimate their understanding of financial products, particularly cryptocurrency, and underestimate the associated risks.

Many do not recognise the need to set aside money for a rainy day and are unclear about the role of regulators, often viewing them as enforcers rather than protectors or educators.

Worryingly, we also observe that younger people increasingly trust sources on the internet and social media more so than previous generations. Nearly a quarter (22 per cent) of retail investors are making investment decisions based on digital promotions or celebrity endorsements seen on social media.

On the positive side, analysis of work by the Central Bank of Cyprus and the University of Cyprus suggests a ripple effect of financial education.

Financial literacy courses for university students in Cyprus have been found to improve the economic knowledge of those in their immediate networks, particularly those with lower initial financial literacy scores.

This power to create a potential multiplier effect warrants further exploration.

Virtuous circle

As a regulator, the ability to test awareness levels and identify knowledge gaps through our schools’ work is invaluable. It helps shape not only our training but also the design of investor warnings, public awareness campaigns and internal policymaking.

For example, we have issued guidelines to Cyprus-regulated firms stating that providing false or misleading financial advice on social media can be a serious offence. Investment recommendations must meet a regulatory Cypriot and EU standard and be neutral, transparent and free from biased or exaggerated language.

Given the digital and global nature of modern finance, we have also invested in a specialised system to monitor online marketing and social media activity by Cyprus-regulated firms.

This system scans global sources — including social media, forums, video platforms and ad networks — and can trigger instant alerts on keyword combinations.

As we go forward, we see our role expanding to become a leading voice in the field of financial education.

Learning the ropes

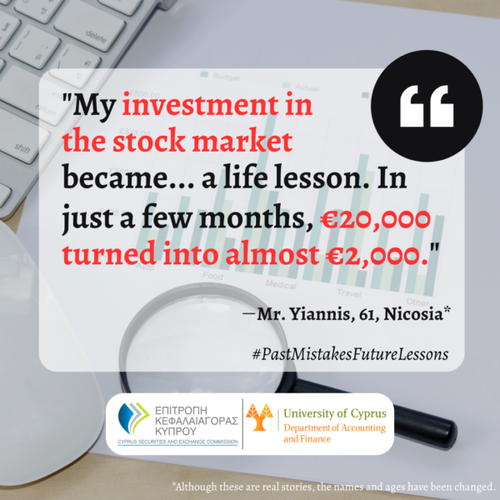

Our latest campaign, Lessons Learned, captures the experiences of ordinary citizens who have made financial mistakes, using their personal stories as powerful lessons for the investing public.

Each contributor tells a story of losing money, whether it’s being tricked by fraudsters or falling into debt because they’ve made a rash decision without doing their research. They all say how they would do things differently.

The Lessons Learned campaign captures the experience of Cypriots who have been scammed

Sadly, poor levels of financial literacy persist and governments have been slow to respond.

A House of Lords report this month urged the UK government to improve the provision of financial education at all levels, commencing in primary and secondary schools, and asked the regulator to develop new literacy programmes.

In April, the European Commission agreed that a more co-ordinated effort, both at a bloc and national level, will be required to raise average financial literacy.

These developments are encouraging.

They show growing recognition of the need for a cultural shift in how we think about regulation — and of the vital role regulators must play in public education.

Any new initiatives being introduced in Europe need to be constructed in the light of digitalisation and the new dangers being presented by growing financial scams, such as unregulated investments and fake communications.

Criminals now impersonate supervisors, using phishing emails to trick consumers into sharing sensitive data.

At CySEC, we have experienced this directly with people fraudulently impersonating CySEC and have published examples of fake emails to raise awareness, as have the FCA, BaFin and other national regulators.

Many of our public guides now focus on helping people protect themselves in the digital financial world.

CySEC has published fake emails fraudulently impersonating the body to raise awareness.

Efforts across Europe and the UK to simplify regulation, remove duplication and streamline processes are welcome.

But without a strong foundation of financial literacy, retail investors will continue to avoid markets they see as too complex, or be lured into high-risk decisions they don’t fully understand.

That undermines all other policy measures. If we want inclusive, confident participation in capital markets, financial education cannot remain an afterthought. It must be a priority.

- Dr George Theocharides, Chairman of the Cyprus Securities and Exchange Commission