Liquidator figures outline the anticipated outcome as Laiki’s shares in the Bank of Cyprus are liquidated

Marios Adamou 07:47 - 11 July 2024

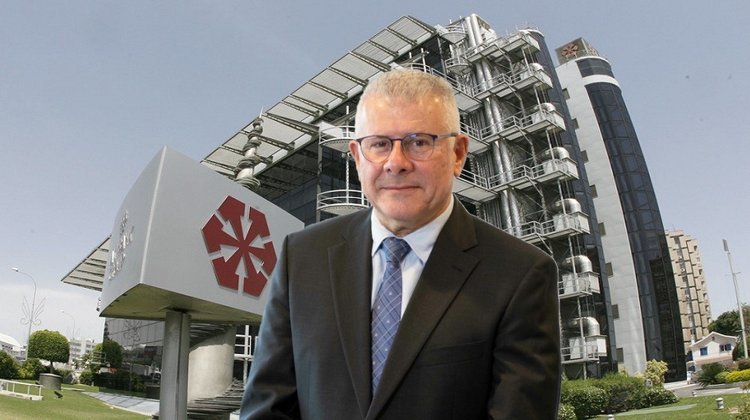

Information regarding the collections and payments from 31 May, 2022 to 31 May, 2024, as well as for expected future collections from the liquidation and/or utilisation of assets of the former Laiki Bank, have been presented to the creditors by Liquidator Avgoustinos Papathomas, during a general meeting.

More than 500 creditors attended the meeting that took place at the offices of the Liquidator and submitted a series of questions to Papathomas in relation to the course of liquidation of Laiki Bank.

According to the data made available, over the course of two years, the Liquidator, through various actions, collected an amount of almost €238 million, while in the future it is expected that at least another €88 million will be collected.

In the period May 2022-May 2024, various payments totaling €1.6 million were also made.

Collections

As regards collections, as stated in the Liquidator's report, with his appointment, the cash deposited in accounts at the Central Bank of Cyprus totalled €182,597,933.

Also, €47,421,320 was collected from the sale of the share capital of Lombard Bank (Malta) Plc, which was owned by Laiki Bank at a percentage of 49%, while following adjudication and/or withdrawal of lawsuits pending against Laiki and in the context of which costs were awarded for the benefit of which the total amount of €104,818 had been recovered by 31 May, 2024.

The Liquidator, through his actions, managed to collect an amount of €32,741 in relation to canceled debts in Greece, as well as €44,984 for the cancellation of letters of guarantee of the Laiki branch in Greece, which remain liabilities of the branch.

In addition, following the actions of the Liquidator, a total amount of €18,014 has been returned, which concerns part of the costs of the arbitration court in Greece regarding the dispute between Laiki and Ireon Investments Ltd in relation to the sale of the company's Greek subsidiaries.

Furthermore, a total amount of €45,098 has been refunded which concerns part of the costs of the International Center for Settlement of Investment Disputes (ICSID) arbitral tribunal in relation to the dispute between the People's Republic and the Hellenic Republic.

Moreover, due to the fact that Laiki owns 21,467,719 shares in Bank of Cyprus, which represents 4.81% of its share capital, a dividend of €1,073,386 was received in 2023 and a dividend of €5,366,930 in 2024.

In addition to the Bank of Cyprus, the former Laiki held 11,471 ordinary shares in the shipping company Star Bulk Carriers Corporation which is listed on the New York Stock Exchange, from which, during the period between the appointment of the Liquidator and the sale of the said shares, gave out a dividend of €38,608.

It is noted that, in 2022, the Liquidator sold the said shares for the total amount of €228,388.

In addition to the above, €861,250 was collected from bank interest, as well as an amount of €259, which was charged by the Bank of Cyprus as liquidity costs, following the Liquidator's request to the Bank of Cyprus.

Anticipated collections

Along with the aforementioned, the collection of amounts is expected regarding the following outstandings, which for the time being cannot be calculated with certainty:

- Recovery of attorneys' fees awarded from court proceedings that have been completed or withdrawn.

- Collections for the cancellation of letters of guarantee issued by the Company in Greece and/or against canceled loans in Greece and/or for the cancellation of registered encumbrances in Greece.

- Collection of damages on the basis of judicial and/or arbitration decisions and/or proceedings including the arbitration dispute between the Company and the Hellenic Republic.

- Return of amounts deposited in escrow accounts.

Also, among other things, the shares held by Laiki in Bank of Cyprus (21,467,719 or 4.81%) will be liquidated through an over-the-counter sale process with the appointment of advisers, with the aim of maximizing the proceeds for the benefit of creditors.

From the sale of the shares, the Liquidator expects to receive an amount of €88,018,000, which was calculated based on the share price on 30/06/2024, which was €4.10.

Payments

In relation to the payments made from 31 May 2022 to 31 May 2024, the Liquidator informed the creditors that an amount of €945,098 was paid in legal fees for the defence of the lawsuits against the company in Cyprus.

It is noted that of the 1,328 legal proceedings pending in Cyprus on 31/05/2022, 396 are still pending, of which 23 are continuing by virtue of the court's permission and 373 are under suspension.

Also, an amount of €37,249 was paid in legal fees for cases pending abroad, while an amount of €68,213 was paid in legal fees for the company's lawsuit against Andreas Vgenopoulos and others.

Also, an amount of €61,605 has been paid to the company's consultants in Greece and Russia for other legal and accounting services, €286,531 to partners who provided services to the company during the special administration and who continued and/or continue to provide services to the company and the Liquidator, €43,649 to custodians for keeping records of holders of the company's securities and shares and €1,181 for bank charges.

In addition to the above, an amount of €5,089 has been paid for stationery and other expenses, €1,568 for printers, €106 for couriers, €89,603 to the Bank of Cyprus, based on the Service Provision Agreement dated 02/03/2014 by which the Bank of Cyprus took over, and continues to provide, among other services, maintenance and/or management of the records and information held by the Company on 29/03/2013, date of transfer of the Company's operations to the Bank of Cyprus and €76,349 to the Tax Department – VAT.

Creditor claims

With regard to creditor claims, the Liquidator states that so far a claim has been submitted and verified by only one privileged creditor.

More specifically, the Taxation - VAT Department submitted a debt verification requirement for an amount of €1,066,111, which concerns a VAT certificate, and which is considered privileged on the basis of Article 300(1)(a)(ii) of the Companies Law, Chap.113.

It is noted that there are five lawsuits pending against the company before the Cypriot courts, and which, if successful, are likely to create privileged rights.

Of those lawsuits, three relate to the company's former employees' provident fund, one is brought separately by a former employee of the company and concerns his provident fund, and one concerns alleged damages to a former employee of the company.

The total amount of the claims in the above lawsuits amounts to approximately €78,300,000.

In addition, according to the Liquidator, a debt verification request has been submitted by the Central Bank of Cyprus in its capacity as Resolution Authority, for an amount of €24,100 regarding operating expenses and resolution costs for the period 01/01/2022 to 05/31 /2022.

At the same time, until June 30, 2024, a total of 5,536 debt verification claims from non-privileged creditors have been received by the Liquidator, of which 5,432 claims have been verified for the total amount of €2,320,800,260.

The Liquidator continues to receive debt verification requests from creditors where good cause is shown for the delay in submission.

(Source: InBusinessNews)