Raising Capital: Trends and Strategies for Private TMT Companies in 2024

Nikolay Shestak 08:38 - 07 March 2024

The Technology, Media, and Telecommunications sector, commonly referred to as the TMT sector, has evolved in the last couple of decades to emerge as the home of companies focused on new technologies.

Today, the TMT sector includes hardware companies such as International Business Machines Corporation (IBM), software companies such as Microsoft Corporation (MSFT), telecoms such as AT&T Inc. (T), and OTT content streamers such as Netflix, Inc. (NFLX) that represent more than one category in the tech sector.

A common characteristic among TMT companies – regardless of the subsector they represent – is the capital intensiveness of their business models. A survey conducted by Ernst & Young in 2022 found that 87% of TMT company executives believe the success of their recovery from the Covid pandemic depends on attracting substantial capital investment. There are several reasons behind this, including the high R&D costs incurred by TMT companies to explore new technologies, substantial amounts spent on infrastructure developments, and regulatory capital deployed to ensure compliance with various types of legal requirements.

Diving deep into the dynamic world of the Technology, Media, and Telecommunications sector (TMT), this article presents analysis, enriched with expert insights from Zubr Capital, a private equity firm focused on investments in private fast-growing companies in the TMT sector.

Current Landscape of the TMT Sector & Capital Raising Trends in 2024

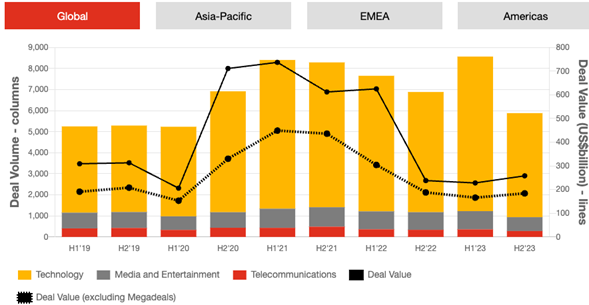

The TMT sector proved to be a hotspot for capital raising in the first half of 2023, with the sector registering approximately 8,500 new M&A deals, eclipsing the previous record set in the first half of 2021 for 8,400 deals. However, tables turned in the second half of 2023, with deal volume declining more than 30% compared to H1 2023.

Exhibit 1: TMT deal volumes and values

Source: PwC

Factors that influenced this decline in deal volume include macroeconomic uncertainty stemming from rising interest rates, surging inflation in many leading global economies, and geopolitical uncertainty resulting from tensions in the Middle East and Eastern Europe.

A more granular view of global capital-raising trends reveals Europe has emerged as a hotspot attracting new capital of late. Europe was the only global region to exhibit a positive change in invested capital in the first 9 months of 2023 compared to 2020, which highlights the increasing appeal of European nations for long-term investments.

Exhibit 2: Capital invested and change in capital invested (%) by region, 2020 versus 2023

Source: Invest Europe

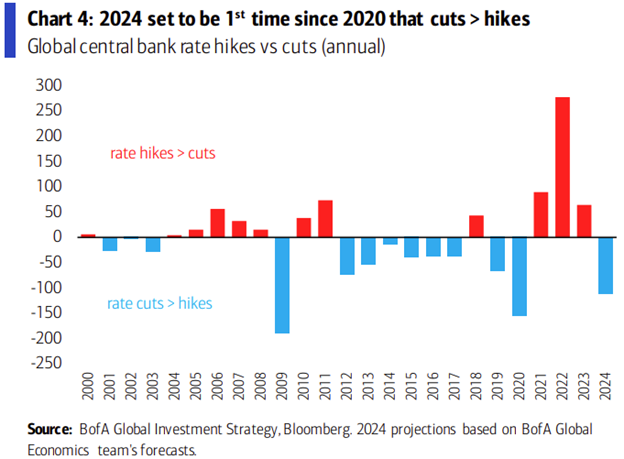

There is optimism for a broad recovery in TMT capital raising activities in 2024, aided by the substantial investments pledged by big tech companies to progress toward achieving their ambitious AI goals. Greater certainty surrounding interest rates will act as a catalyst in attracting capital from private investors in the private equity market. According to data compiled by Bank of America, 2024 will be the first time since 2020 to register more rate cuts than hikes, with 152 interest rate cuts expected this year from global central banks.

Exhibit 3: Central bank rate hikes vs cuts

Source: Business Insider

According to PwC, several trends will dominate the TMT capital-raising landscape in 2024;

- Continued dominance of the software sector in attracting capital.

- Streaming sector consolidation.

- A record level of private equity involvement in capital-raising activities as a result of the growing trend of profitable companies going private.

- Increased regulatory scrutiny, especially in Europe.

The TMT sector is gearing up for a meaningful recovery in capital-raising activity in 2024 but the outlook greatly depends on expectations for less hawkish monetary policy decisions across the globe.

Strategies for Raising Capital

Traditional funding sources for TMT companies include public capital markets and private investments. Today, the industry is undergoing a two-pronged transformation with TMT companies using innovative marketing methods to attract capital while trying to raise capital from retail investors without accessing traditional public markets.

From a marketing perspective, the increasing use of social media to attract venture capital investors stands out as a key theme. According to a study conducted by the Wharton School of the University of Pennsylvania in 2022, social media platforms are playing a key role in alleviating some capital-raising inequalities, which is one of the main reasons behind the increasing use of social media to attract VC investors. Another study by Wharton revealed that social media activities of tech startups can meaningfully impact the investment decisions of private investors.

Staying true to the above findings, many TMT companies are actively using social media to influence the investment decision-making process of the general public and institutional investors. This trend is likely to accelerate in 2024 along with increased use of AI technology to reach potential investors.

From a strategic perspective, TMT companies will have to establish a meaningful social media presence and actively engage with existing and potential investors to gain an edge over their competitors in attracting capital.

TMT companies may embrace crowdfunding too, which has grown exponentially over the last five years. Crowdfunding has evolved to cater to various types of funding requirements, including equity-based crowdfunding and debt-based crowdfunding, presenting TMT companies – especially the ones that have limited access to public markets – to raise capital efficiently. The global crowdfunding market is expected to grow 16% in 2024 to $17.9 billion.

Future Outlook: Challenges and Opportunities

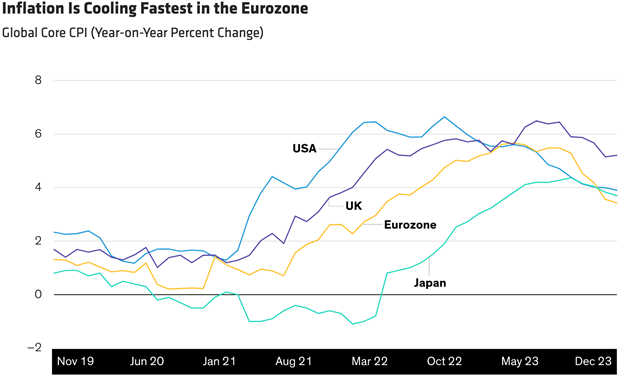

The biggest risk facing the TMT sector in 2024 is a potential reversal of the Fed’s expectations for at least three rate cuts this year, which would make it challenging for TMT companies to raise capital in the United States. The Eurozone, however, offers a ray of hope with inflation in this region cooling the fastest compared to the U.S., UK, and Japan.

Exhibit 4: YoY change in core CPI in key regions

Source: Alliance Bernstein

Cooling inflation in the Eurozone is likely to prompt the European Central Bank to cut rates this year, with the median prediction pointing to 100 basis points of rate cuts, pushing the ECB deposit rate down to 3% by the year-end.

If expectations for rate cuts do not materialize, the TMT sector may fall agonizingly short of meeting original funding targets.

Opportunities exist for TMT companies to raise capital aggressively. The continued investor appetite for innovation, the growing number of public-to-private transactions, the growth of subscription-based business models, the rise of impact investing, and the exponential growth of digital securities are some of the factors that have created new opportunities for TMT companies to raise capital.

Certain demographic trends may also create opportunities for TMT companies to exploit. For instance, the rise of Cyprus as a global investment hub enables companies to expand their horizons and raise capital in new markets. Cyprus, in the first half of 2022, emerged as one of the fastest FDI markets to recover from the Covid slump, ranked 3rd worldwide. This stellar recovery highlights Cyprus’ value proposition as a global investment hub for the TMT sector with a positive economic outlook and an attractive tax regime while offering seamless access to key global markets including Europe.

The global TMT sector is gearing up for a busy 2024 with several macroeconomic tailwinds expected to drive fundraising activity higher this year. With innovation taking center stage coinciding with the rise of 5G technology and AI, investors will continue to look for opportunities in the TMT sector to support the ongoing technological revolution.

Nikolay Shestak, Partner at Zubr Capital Responsible for investor relations of the Fund