Andreas Yiasemides: Investment funds can help diversify Cyprus’ economic model

16:18 - 15 February 2024

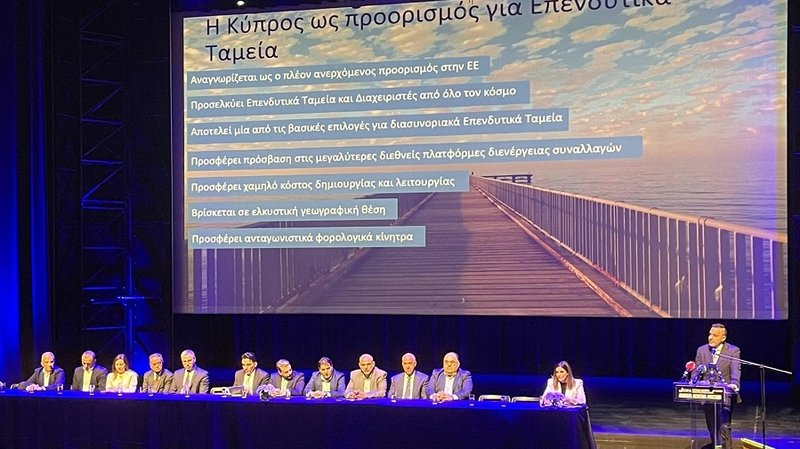

Addressing the Cyprus Investment Funds Association’s AGM for the last time as CIFA President, Andreas Yiasemides has underlined the important role investment funds have within the country’s economy.

He also outlined the important work carried out by CIFA and reassured the new Board, due to be elected within the framework of the AGM, that he and the other outgoing members would remain at their disposal.

In his final address as CIFA President on 15 February, Yiasemides noted, “This year's Assembly is of particular importance to the members of the Association's Board of Directors as several of us are leaving after a decade or so. A decade in which Investment Funds were established and Cyprus recognised as a leading and attractive destination, something that is not being said by us, but by the most reliable international organisations such as the European Fund and Asset Management Association, EFAMA.”

As underlined by Yiasemides, “This is also proven by the hundreds of investment funds that have already been licensed and invest through Cyprus as well as in Cyprus, as well as the dozens of investment fund managers that have chosen our country.”

He added that this had also been demonstrated by the fact that the largest international trading platforms are accessible to Cypriot funds.

“We are optimistic that the interest from Investment Fund Managers from abroad will continue since our country has nothing to envy from established international centers of investment funds,” Yiasemides said.

He also took the opportunity to address the members of parliament attending the AGM, “To once again appeal for the rapid passage of the bill governing the management of investment funds, which is extremely important precisely because it will complement the regulatory framework.”

On a more positive note, Yiasemides noted that Cyprus investment funds had managed to offer an attractive and quality product, at what he described as a comparatively lower cost than competing destinations, “which is an important factor for collective investment organisations, especially for those that are smaller in size and manage funds up to 500 million euros.”

“Combined with targeted incentives and the wider comparative advantages of our country, we managed in a short period of time to develop a sector that practically did not exist until 2014,” he said.

A collective effort

Yiasemides went on to note that the development of a sector that had started from scratch was no accident: “It was the result of common and collective work. Ours as a private sector, but mainly of all those who embraced the sector and believed in its perspective.”

He thanked the governments of recent years, parliamentary parties, the relevant ministries and the Ministry of Finance and Invest Cyprus in particular, noting that they had included Investment Funds in its priority pillars. He also thanked the supervisory authority, the Securities and Exchange Commission (CySEC) which he described as “a strict but fair supervisor.”

“Thanks also to our members, who in difficult and challenging times demonstrated a high level of professionalism and were worthy ambassadors for our country inside and outside Cyprus,” Yiasemides added.

The outgoing CIFA President went on to underline that, “The benefits from the growth and development of the Investment Funds sector are many and particularly important. First of all, new, well-paid jobs arise in a sector different from the traditional provision of professional services which, as we all know, has been redefining its operating model in recent years.”

He said new employment opportunities are created both for Cypriots and for foreigners with a high level of education and skills through the sector, noting, “We have typical examples of organisations that have grown significantly in recent years offering either direct collective investment services, or serving these organisations that, as I said, are strictly supervised and to which many regulatory barriers are applied.”

Yiasemides also said that, at a time when investments were particularly important for the sustainable development of the Cypriot economy, more than 25% of the Assets of the investment funds or funds in excess of 2.3 billion euros have been invested in various sectors of the domestic economy such as shipping, renewable sources energy, education and technology.

An alternative pillar of business and development project financing

He went on to note, noting that in a period when lending rates are at particularly high levels due to the European Central Bank's attempt to tame inflation, “investment funds are an alternative pillar of business and development project financing. Internationally, the assets of open-ended investment organisations exceed 64 trillion dollars. I am sure that we can attract more funds as well as direct investments in the economy.”

Yiasemides also reminded the audience that investment organisations, in addition, contribute to public finances through taxes and establishment and operation fees that they pay to CySEC, which, at the same time, their activity in Cyprus increases the demand for office spaces and contributes to the strengthening of consumption.

“Bearing in mind all these benefits arising from the development of the sector are obvious. However, the undertaking is anything but easy. There is a lot of competition in the international market to attract the trillions managed by investment funds,” he noted.

Yiasemides said that CIFA constantly monitored international developments, and submitted recommendations to the competent supervisory authority and to the legislative body in order to improve and strengthen the Cypriot proposal for investment funds.

“Indicative are the initiatives we undertook in relation to important issues that improved the regulatory framework, such as the legislation on (Registered Alternative Investment Funds) RAIFs, partnerships and the fund administration,” he said.

CIFA also organised specialised seminars for the training and information of the members of the Association and monitored the events and developments of the sector through the Association’s 11 committees.

“For the purpose of promoting Cyprus as a destination for investment funds, we maintain strong participation in international conferences and exhibitions in targeted markets abroad. 2023 in particular was a landmark year both for our Association and for Cyprus in general, since we managed to win the hosting of the 36th annual conference of the International Investments Funds Association, which was attended by executives from the largest centres of investment funds such as USA, Japan, China, United Kingdom, through which more than 70 trillion dollars are managed,” Yiasemides said. “The conference, I dare to say,” he continued, “was one of the most successful organised in recent years, and this is not something we are saying ourselves, but that has been conveyed to us by the participants themselves, who are already the best independent ambassadors of the country abroad. At this point I would like to thank Invest Cyprus for its financial support which was necessary for the organisation of the conference.”

A dynamic association

Yiasemides that CIFA had developed into a dynamic association with a high number of members and which maintains a loyal partnership with professional bodies such as the Institute of Certified Public Accountants of Cyprus (ICPAC), the Association of Cyprus Banks, the Charted Institute for Securities & Investment (CISI) Cyprus and Chartered Financial Analyst (CFA) Society Cyprus. Additionally, we maintain an open line of communication with government departments such as the Tax Department and the Registrar of Companies.

“We also place special emphasis on education and training related to collective investments. To this end, we have signed a memorandum of cooperation with a higher education organisation and participate in various career events. We are also particularly pleased by the fact that courses directly linked to collective investments are now offered by higher education institutions in our country. Another indication of the evolution recorded by the sector,” he said, adding CIFA was a member of international organizations such as the European Fund and Asset Management Association, International Investment Funds Association and the International Capital Market Association.

“The benefits of developing mutual funds are many. Especially at a time when an effort is underway to modernise and diversify the country's economic model, assisted by the projects of the Recovery and Resilience Fund and implementing the ‘Vision 2035’ Plan. It is important, especially for a small and flexible economy like Cyprus, that new and promising sectors such as investment funds enjoy universal support, because at the end of the day we all benefit,” Yiasemides said.

“As these are my last moments as President of CIFA, I feel particularly moved and proud of what we have accomplished and achieved over the past few years. I express my gratitude to my colleagues on the Board of Directors and the Association’s personnel for the commitment and time they have dedicated to achieving our common goal,” he said, before concluding, “I am sure that the new Board of Directors will continue, with the same zeal and intensity, the effort to develop the sector and they can be sure that whenever I am asked, I will be by their side. As I'm sure the other members of the Board of Directors who are leaving will also be.”