Data-driven decision making: Leveraging data - the path to gaining a competitive advantage

Andreas Spyrides and Phanis Ioannou 10:25 - 10 May 2023

Every company in the world strives to gain a competitive advantage in an effort to enable either the production of superior goods and services or to achieve lowering of their costs. In the age of Artificial Intelligence, Cloud solutions, and increased computing power, utilising data to remove biases and improve decision making makes such a competitive advantage more easily accessible than before.

It can be argued that what describes the culture of an organisation is the series of steps and routines that it follows in making business decisions. The way to minimise human biases in the decision-making is to introduce factual thinking processes by utilising the power of data. Capturing data insights appropriately, always yields to the most objective and unbiased decision. As a result, the organisational culture needs to be supplemented by a data-driven mechanism to enrich the way decisions are being made and reduce opinion-based decisions, which could in some cases be subjective and interest-based.

Adopting a data-driven decision making allows organisations to identify patterns and become more customer-centric; allowing therefore for more educated decisions to be made, and potentially securing the loyalty of customers with the company. Specialised products could be identified while the customer experience could be enhanced, adding value to both, the customer, and the organisation. These are a few examples from a plethora of potential advantages that can be explored via the use of data.

In what manner can an organisation adopt such a mechanism and what obstacles could be identified on the way to adoption?

Data literacy is the most crucial factor for securing success and that kind of mindset must be promoted by the top management. For example, a board member that is educated about the benefits of data-driven decision-making will ask for data-driven knowledge to be presented to them, in order to have all the factual evidence required to form their own opinion. Similarly, the fear of redundancies due to automated decision-making which could replace the human experience-based judgment, is another obstacle of adopting such a mechanism in an organisation. In reality however, what makes people redundant, is the failure to elevate their skills to match the industry’s demands.

As in the case of every significant business transformation, in altering the business procedures and processes into a data-driven decision mechanisms, one needs to have the support of executives, such as the directors or CEO, in order to be able to tackle all those obstacles that can be faced on the way forward. At the same time, all key stakeholders need to be properly informed and actively involved; it is crucial to ensure effective collaboration between everyone involved in the transformation process. Data quality or even data unavailability might be considered as showstoppers at the beginning, but, although important, they are not critical for the successful implementation. By starting the journey of business transformation, businesses can then tackle such issues progressively over several stages until the ideal state is reached.

Once the above mindset is achieved, what are the conditions that could lead to the organisation gaining a competitive advantage?

There are many companies that are built on data and have been around for many years. Even in Cyprus, take the example of Artemis, Cyprus’ Credit bureau which collects and provides information about the financial behaviour of individuals and legal entities since 2008. Such companies are protected by significant barriers of entry because of the huge amount of data they already have and achieving economies-of-scale [in microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time] would not be easy for any new competitor. However, such organisations do not aim at collecting customer information in order to better understand the client and improve offering, instead their competitive advantage is based on the high volume of data they already possess. On the contrary, a Bank collecting customer information in order to determine the risk of loss from default of a customer, is aiming at data-enabled learning to better understand the risk profile, and as a result price its products, accordingly, optimise its strategy and also make its products more attractive to clients. In other words, there is an incentive to use customer data in a way that they can be transformed into a competitive advantage for the business.

Let us think how much value can be added though by customer data. For example, Tesla’s self-driving cars requires a huge amount of data from drivers in order to improve its capabilities and as a result to further safeguard safety. This is of utmost importance and increasing accuracy even by a tiny amount is critical. On the other hand, a TV manufacturer collecting customer data for a TV program recommendation system, might not be so relevant, as customers care more about the size and picture quality of the specific product when making a purchase decision. As a result, it is important to understand how to extract the right decisions from the data at hand and how additional value can be generated, in a company’s offering, before proceeding to such business decisions.

Furthermore, another important aspect to consider is how fast the relevance of the data depreciates. Again, if we take the example of Tesla’s self-driving algorithms, the value of data does not seem to depreciate, in the short run at least, as driving patterns remain relatively stable. Conversely, think about Zara collecting information about clients’ demands. How relevant could that data be in a year or two, when the preferences regarding fashion designs and trends shift quickly over time? This means that Tesla’s use case is building a long-term competitive advantage while in Zara’s case, it helps the company predict the short-run demand, which is still important for matching customers’ needs, but the data quickly becomes irrelevant and makes it difficult to build a sustainable competitive advantage if the data is not frequently revisited. Therefore, long-term competitive advantage from use of data, also depends on the business model and the specific use case in an organisation.

Can the data also be used to improve the internal processes of an organisation?

Customer-data could be used for internal purposes as well, which will have an indirect impact on customer experience. Think for example the case of a Motor Insurance company receiving fake claims from customers about car accidents. That requires a significant amount of investment from the company in time and money, in order to assess and verify whether a claim is fraudulent or not; this decision will impact the amount of cases for which further court-related actions are necessary. On the other hand, once the insurance company has collected sufficient customer data internally, it can build a fraud-detection model based on these data, to predict, with predefined confidence, such fraudulent claims and minimize the time of claims management for those that are not classified as fraudulent, while taking more intensive care for those that are predicted to be fraudulent. In the age of Artificial Intelligence and Machine Learning such developments are not science fiction and could help organisations evolve rapidly.

Is adoption of a data-driven decision making, hard?

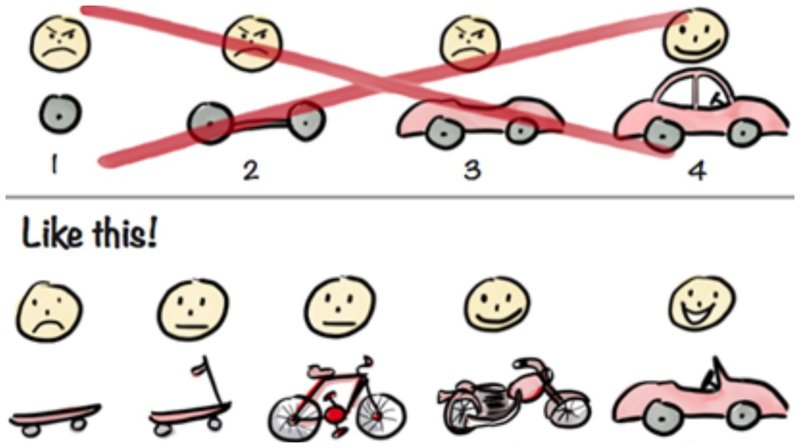

Based on the above, it is vital for an organisation, which is pursuing data-driven decision making and the use of customer data for gaining a competitive advantage, to understand which parts of its business model and its products or services are the most relevant for generating value for the business and its customers. Data-driven decision making is a journey that requires involvement of all stakeholders. It is important to understand that although adoption might be hard, organisations have the option to approach this implementation in a more agile way. Thinking about the end goal as being too far away, may push people back, while taking initiatives and starting from basic steps and low-hanging fruits will certainly be the best option for such large-scale transformations.

Illustration of MVP product development by Henrik Kniberg

References

https://www.theactuary.com/interviews/2022/02/25/sudaman-thoppan-mohanchandralal-driven-data

https://hbr.org/2020/01/when-data-creates-competitive-advantage

Authors:

Andreas Spyrides, Partner, Head of Quantitative Risk Services, Grant Thornton Cyprus

Phanis Ioannou, Manager, Quantitative Risk Services, Grant Thornton Cyprus