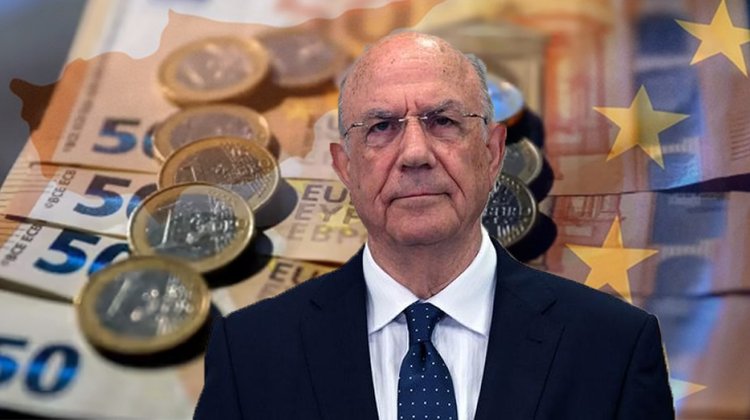

Finance Minister announces measures to contain public wage bill

14:15 - 08 December 2023

Finance Minister Makis Keravnos has announced two new measures that the Ministry believes will contain the pubic wage bill.

Presenting the 2024 state budget to the Parliament’s plenary, Keravnos also noted that amid the global uncertainty the Cypriot economy remains resilient and strong, stressing that despite satisfactory economic performance “we are not complacent.”

He referred to the need to contain the public wage bill, noting that in the beginning of each year, the Finance Ministry will table to the Council of Ministers for approval the necessary new job positions in the public sector, after consultations with the Ministries and Deputy Ministries, while an external advisory body will be assigned to carry out a study for the rationalisation of the public wage bill on the basis of international and European standards.

These will constitute a first step with a view to avert a medium-term and long-term tendency over the increase of the state wage bill, he added.

Referring to Cyprus’ economic outlook, Keravnos said the economy is projected to expand by 2.9% in 2024, compared with an estimated 2.4% in 2023, while in 2025 and 2026 GDP growth is projected to amount to 3.1% and 3.2%, respectively.

Inflation is estimated to fall to 2.5% in 2024 and will continue its downward trajectory, while unemployment will drop to 2.5% in 2024, from 6.4% this year and is estimated to continue its downward trend in the period of 2025 and 2026.

But he noted that “we recognize the fact that the coming years are estimated to be quite difficult for the global economy and the Cypriot economy as well, while in the medium to long-term a new era of challenges is expected and will be marked by phenomena of de-globalisation and changes required by the green transition, climate change and high energy prices.”

He also referred to the conflict in Gaza Strip, which strengthens uncertainty, with the government assessing the situation constantly and proceeding with additional measures and initiatives.

“Cyprus is a small country with an open economy, which is based to a large extent on tourism and services and is called on to tackle challenges, such as the energy crisis, inflationary pressures and prices hikes households and small and medium-sized businesses are faced with,” he added.

“The government, he said, is called on to maintain a reasonable fiscal balance, maintain a course of sustainable growth, based on reforms and constant improvement of the citizens quality of life,” he said.

According to Keravnos, in 2024 the general government balance will remain in surplus reaching 2.8% of GDP, while public debt will decline to 74.7% of GDP marking a reduction of 40.3 percentage point since 2020, which is the largest reduction among the EU member-states.

“This positive fiscal performance will enable us on the one hand to tackle any potential negative developments, maintaining the capacity to exert social policy, while on the other hand to respond to our European obligations, particularly in reducing the deb-to-GDP ratio,” he said.

Keravnos also noted that the 2024 state budget is premised on realistic macroeconomic projections and weighted all risks and uncertainty.

Primary expenditure (excluding debt-servicing spending) are up by approximately 1.6 billion, development expenditure mark an increase of 14%, whereas welfare expenditure are up by 15%, he added.

The budget, Keravnos said, earmarks €900 million on green economy and €288 million on digital transformation for the period of 2024 – 2026.

“Taking the global challenges into account we have drafted a budget of responsibility, which is called on to support the society and the economy in this difficult period, while turning our eyes to the future, he said.

Furthermore, Keravnos referred to the discussion in the Parliament over the foreclosure framework, pointing out that an effective foreclosure framework is very important in securing financial stability.

He recalled that the government has tabled a revised framework, entailing broader competencies for the Financial Commissioner and a special jurisdiction in the District Court to examine disputes over non-performing loans.

“We believe that under the circumstances the framework is satisfactory and could provide solutions and protections to borrowers,” he said.

(Source: CNA)