The insurance sector in Cyprus continues its steady and accelerating upward trajectory, once again demonstrating its strong momentum and resilience.

This much is clear from the first half statistical results of the Insurance Association of Cyprus (IAC), which have been processed and presented by InBusinessNews.

According to the data, particular interest lies in the competition between Bank of Cyprus and Eurobank, which – following the acquisition of Ethniki Insurance by the former and CNP Cyprus by the latter – has now extended into the insurance sector as well.

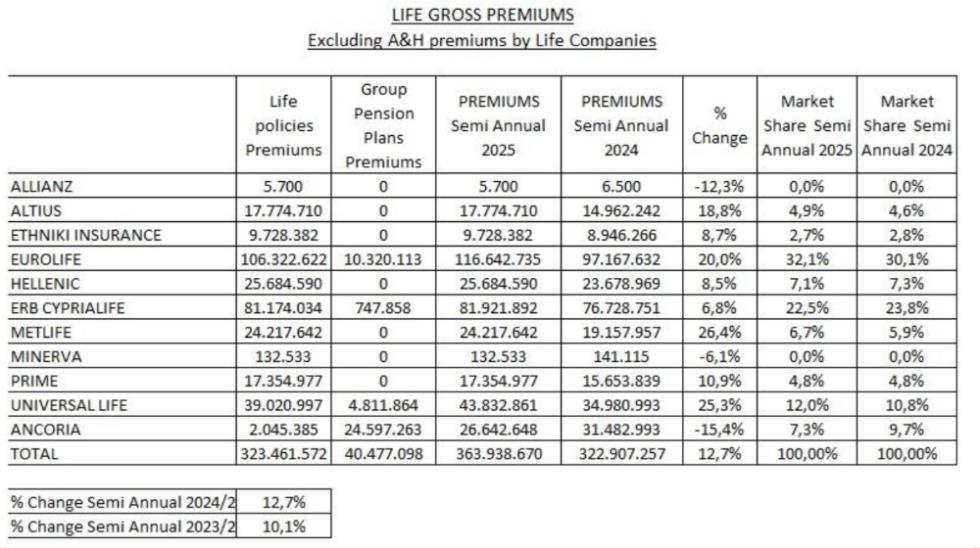

Life insurance sector

In the life insurance segment, IAC's data show that total gross premiums, including accident and health premiums from life companies, reached €423,034,711 in the first half of 2025, up 11.7% compared to €378,780,503 in the January–June 2024 period.

A closer look at the data reveals that Eurolife holds the largest share of life premiums at 30.8%, which at €130.5m were up 18.2% compared to €110.3m in H1 2024.

In second place is ERB Cyprialife, with a 21.3% share and premiums of €90.3m (up 6.7% from €84.6m in H1 2024). Universal Life ranks third with a 15.1% share and premiums of €66.3m (€56.3m in 2024 – an increase of 17.9%).

MetLife ranks fourth with 9% and €38.3m (up 18.3% from €32.3m in H1 2024), while Ancoria Insurance completes the top five with a 6.3% share, totalling €26.6m – down 15.4% from €31.5m in the same period of 2024.

Detailed market share table from the original report:

Excluding accident and health premiums

Excluding accident and health premiums from life companies, total life insurance premiums reached €363,938,670 in the first half of 2025, compared to €322,907,257 in the same period of 2024 – an increase of 12.7%.

Once again, Eurolife leads the sector with a 32.1% share and premiums of €116.6m (up 20% from €97.2m in H1 2024).

ERB Cyprialife remains second with 22.5% and €81.9m (up 6.8% from €76.7m), while Universal Life ranks third with 12% and €43.8m (up 25.3% from €35m).

In fourth place is Ancoria with 7.3% and €26.6m (down 15.4%), and Hellenic Life rounds out the top five with 7.1% and €25.7m, an 8.5% increase from €23.7m in 2024.

Detailed market share table from the original report:

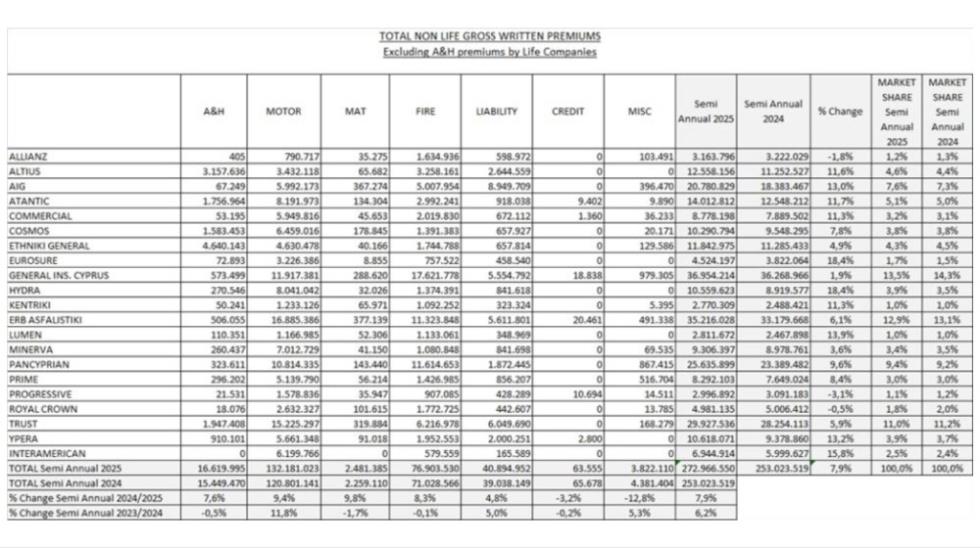

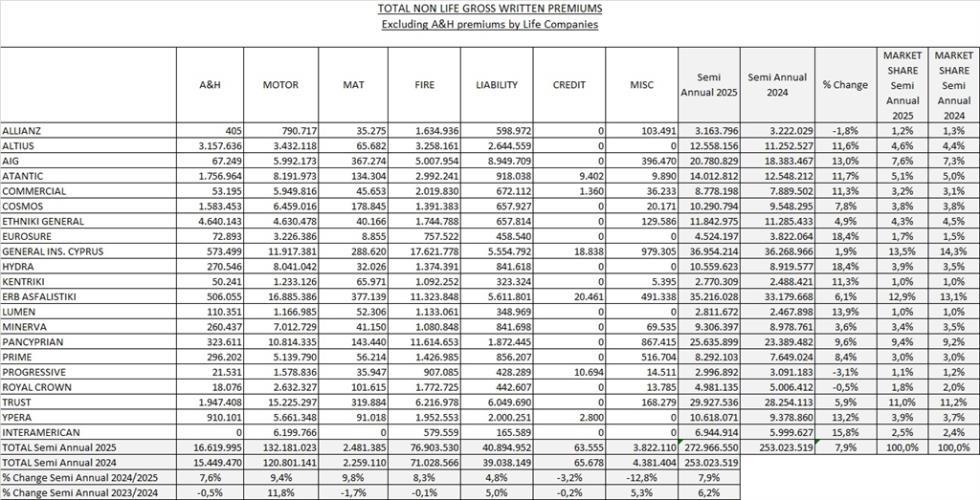

General insurance sector

In the general insurance sector – excluding accident and health premiums from life companies – total gross premiums reached €272,966,550 in the first half of 2025, compared to €253,023,519 a year earlier, marking a 7.9% increase.

According to the data, the largest share of general insurance premiums (excluding accident and health) is held by Genikes Insurance with 13.5%, totalling €37 million, up 1.9% from €36.3 million in H1 2024.

ERB Asfalistiki follows with a 12.9% share and €35.2 million, up 6.1%, while Trust ranks third with 11% and €30 million, up 5.9% from €28.3 million last year.

In fourth place is Pancyprian Insurance with 9.4% and €25.6 million, showing a 9.6% increase, and AIG completes the top five with 7.6% and €20.8 million, a 13% rise from €18.4 million in the January–June 2024 period.

Detailed market share table from the original report:

(Source: InBusinessNews)