The Cyprus Investment Funds Association (CIFA) welcomes the latest positive developments in the Investment Funds sector, as reflected in the Q1 2025 Quarterly Statistical Bulletin issued by the Cyprus Securities and Exchange Commission (CySEC).

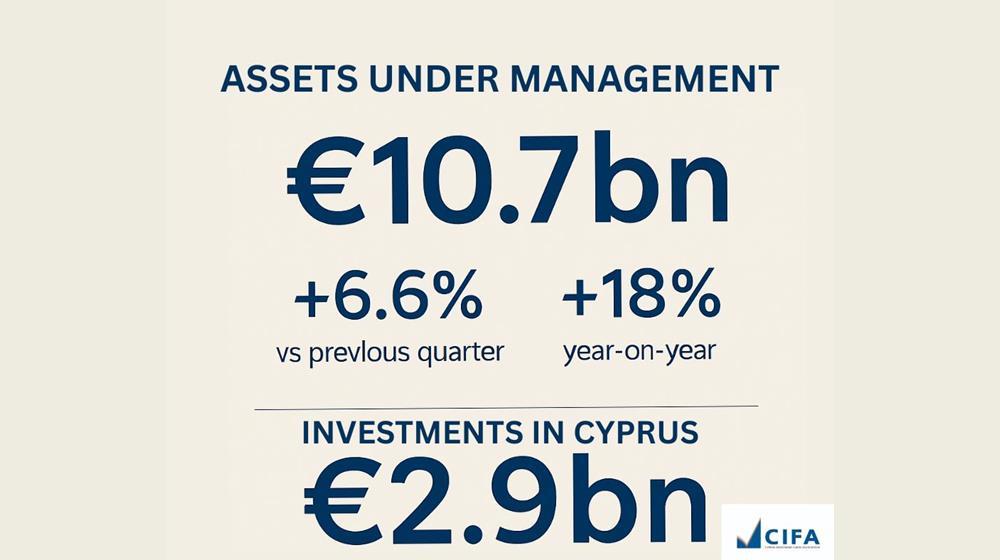

According to the data, by the end of March 2025, Cyprus had a total of 322 Management Companies and Undertakings for Collective Investment (UCIs), of which 254 were active. Total Assets Under Management (AUM) reached €10.7 billion, marking a 6.6% increase compared to the previous quarter and an 18% increase year-on-year. At the same time, total Net Asset Value (NAV) stood at €9.9 billion.

Particularly important for the development of the Cypriot economy is the increase in domestic investments, which reached €2.9 billion and account for 27.2% of the total AUM.

Statement by CIFA President Maria Panayiotou: “The latest figures published by CySEC indicate the continued and sustainable growth of the sector. We do not expect an increase in Assets Under Management or in the number of Investment Funds every single quarter.. That’s not how a healthy sector operates. However, every increase is a meaningful contribution to our shared efforts of consistently strengthening Cyprus’ collective investments ecosystem. Recent milestones, such as the enactment of the new Law on Fund Administration Companies, are expected to further support this positive momentum, and we are optimistic that their impact will be reflected in the coming quarters.”

Stability is a prerequisite

CIFA reiterates that, in today’s highly volatile international environment, stability and predictability are among the most important factors for investors and jurisdictions alike. Preserving Cyprus’ comparative advantages is critical, not only for the Investment Funds sector but also, for the broader economy. Any policy or regulatory changes must be carefully evaluated to avoid weakening Cyprus’ competitiveness vis-à-vis other fund jurisdictions.